The secret of successful investing, more than anything else, is being in the right place at the right time. After much preparation, Vortex Metals Inc. (VMSSF:OTCMKTS;VMS:TSX;DM8:FSE) is certainly in the right place at the right time, and the great news for investors here is that they (you) can be in the right place at the right time by investing in Vortex stock without the necessity for preparation, as the company and the markets have done it all for you!

We'll start by briefly describing the general scene or environment of the metals markets. The metals markets at large are entering a major bull market, with strong gains already being seen in copper, gold, and silver over the past month or two and this bull market is set to accelerate due to the impending collapse of currencies and debt markets and the flight to assets with intrinsic value.

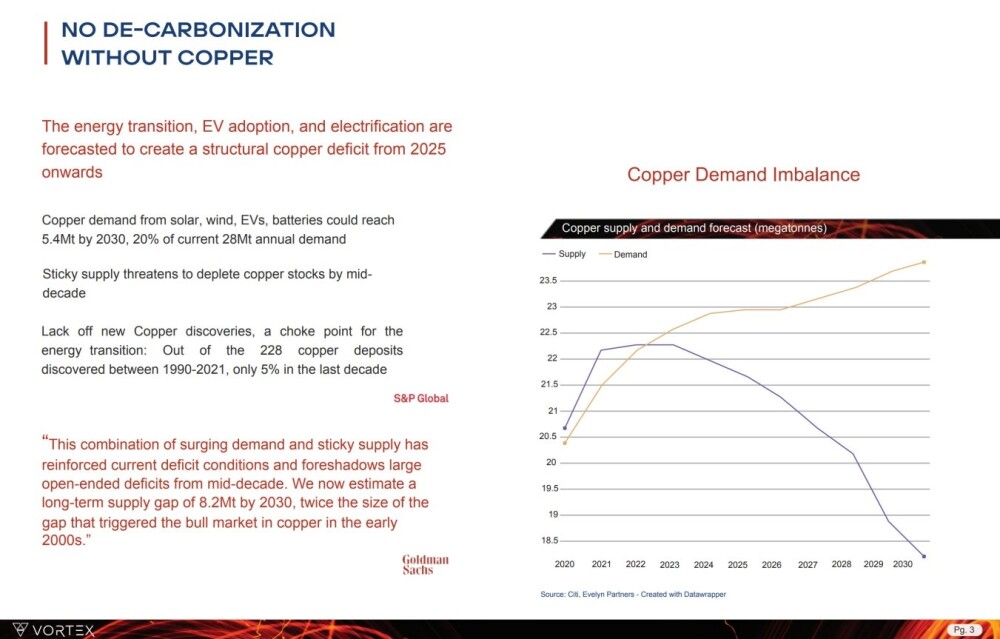

Copper is a special case with a huge supply shortfall incoming due to the combination of an explosion in demand due to the expanding use of copper in batteries for EV's and power storage, etc., coupled with a supply shortfall due to the dearth of major new copper discoveries in recent years, and it just so happens that Vortex is exploring for copper — gold in highly prospective areas.

Just how serious the copper supply shortfall is set to be is made abundantly clear in this slide from Vortex's investor deck, which almost makes the case for buying the stock on just one page. Note the important observation on this slide about copper by Goldman Sachs.

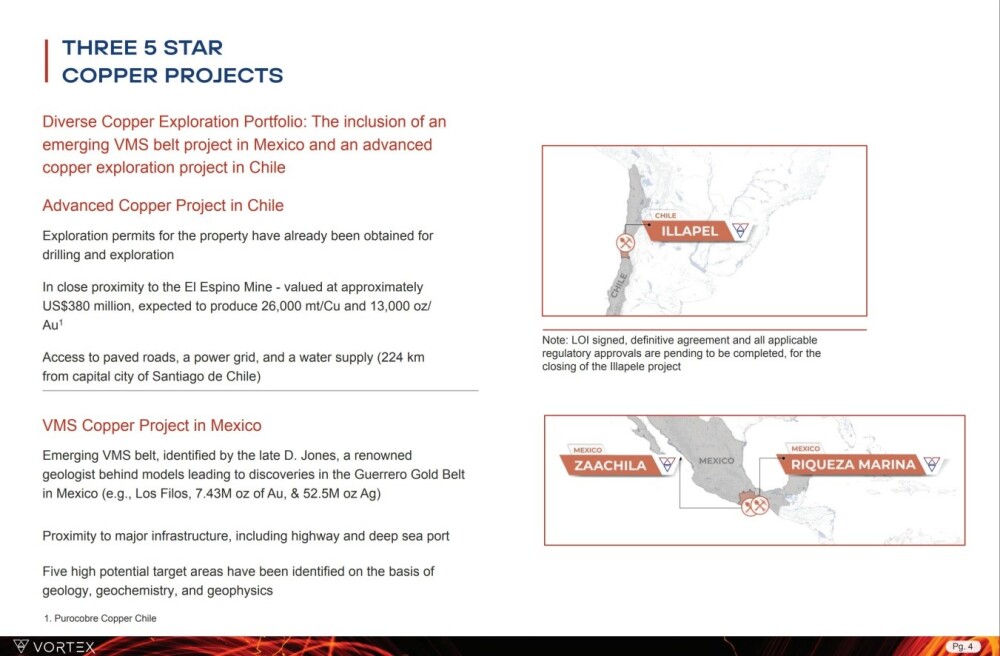

So, what copper projects does Vortex have?

It has three, two in Mexico and an advanced project in central Chile, as set out on the following slide.

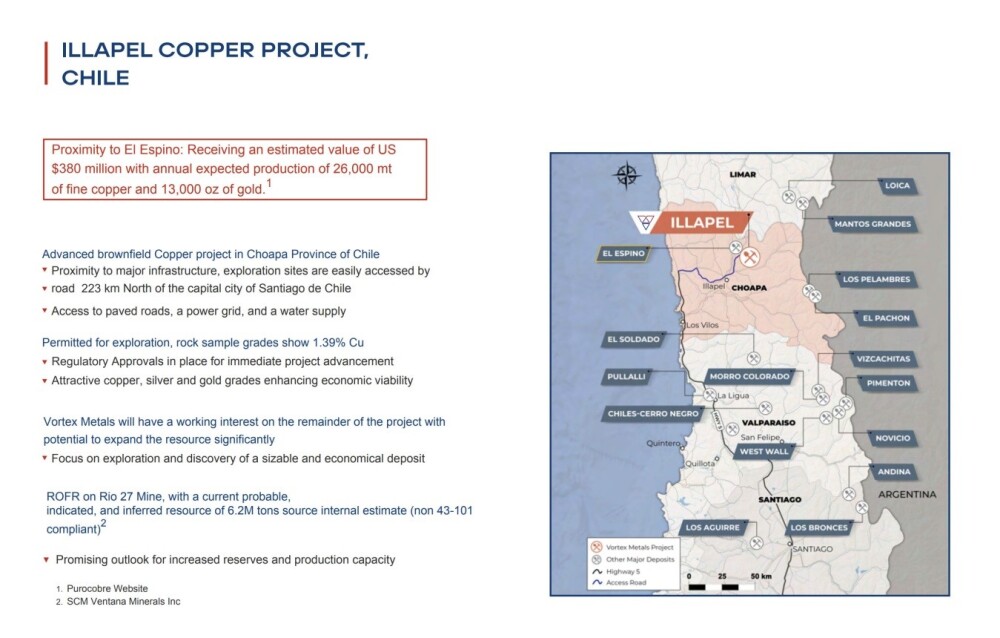

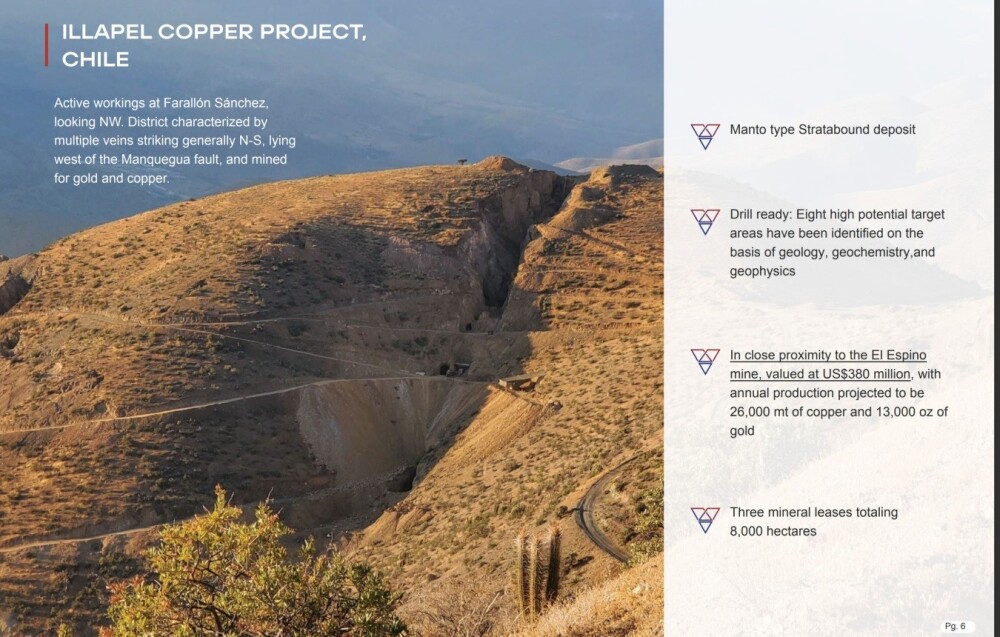

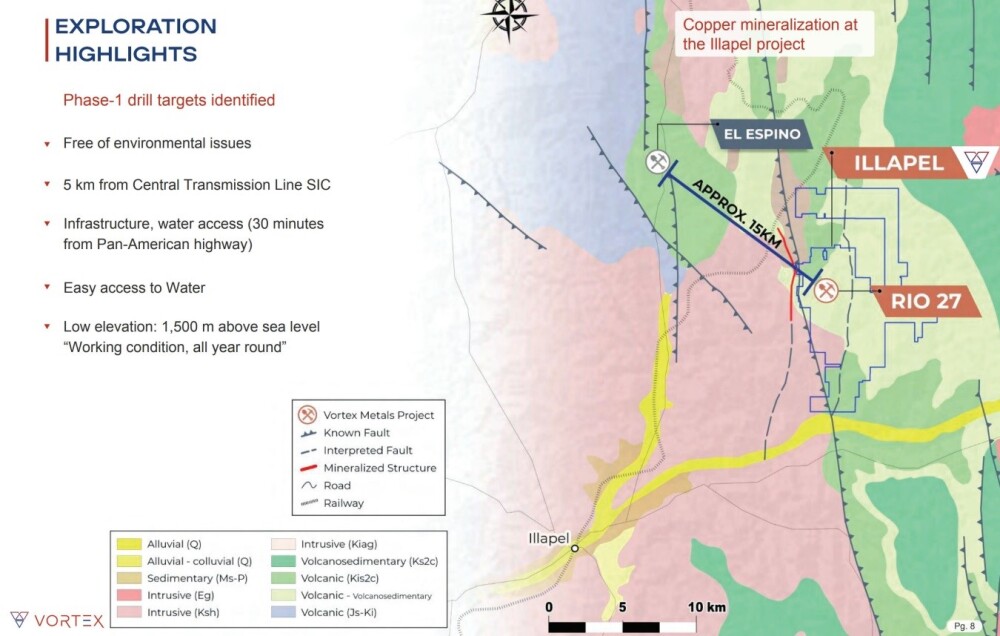

Taking a closer look at the advanced Illapel project in Chile, we see on the following slide its situation in the fourth Region of Coquimbo in central Chile, not very far from the town of Illapel and its proximity to many other major projects in the district, most notably the nearby impressive El Espino copper-gold project which of course bodes well for further discoveries at the Vortex property.

The advantages the Illapel project already enjoys are set out on the following slide.

This slide shows the exploration highlights and other advantages.

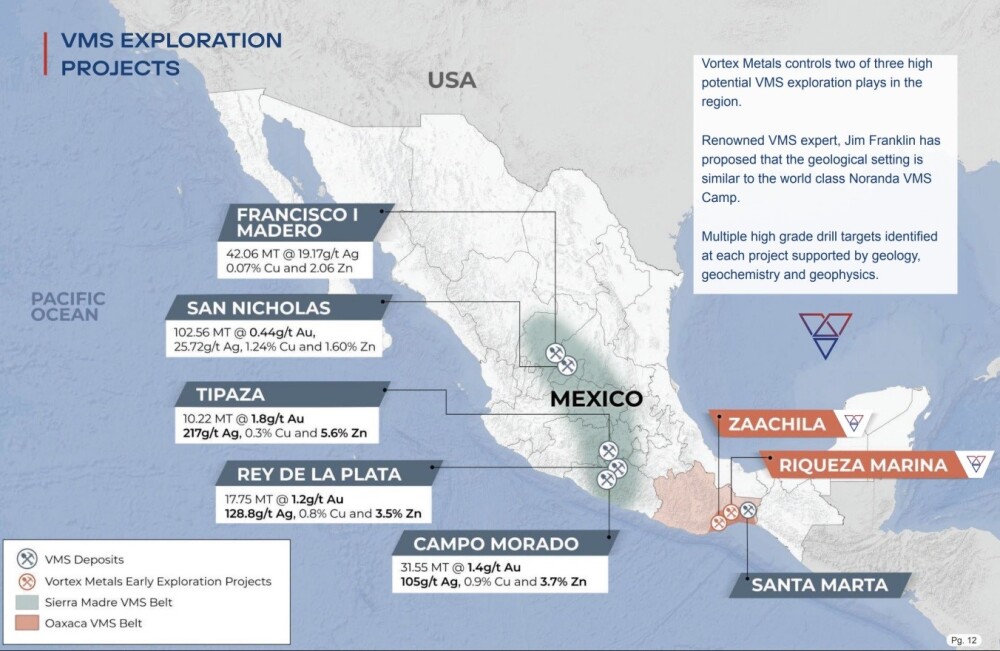

Turning now to the company's other two projects which are in Mexico, the following slide shows their position in southern Mexico within the Oaxaca VMS belt and relative to other important mines / projects in the country.

For those who don't know, VMS stands for volcanogenic massive sulfide ore deposit.

Of particular note is that renowned VMS expert Jim Franklin has proposed that the geological setting is similar to the world-class Noranda VMS camp.

The advantages of these projects are as set out on this slide.

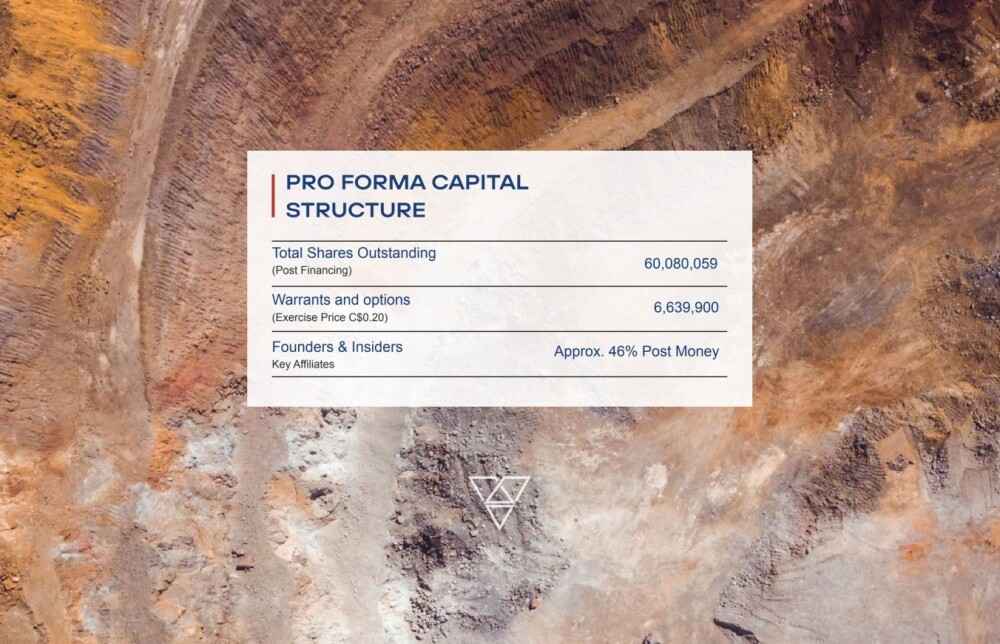

Total shares outstanding are about 60 million, with founders and insiders owning about 46% of the stock.

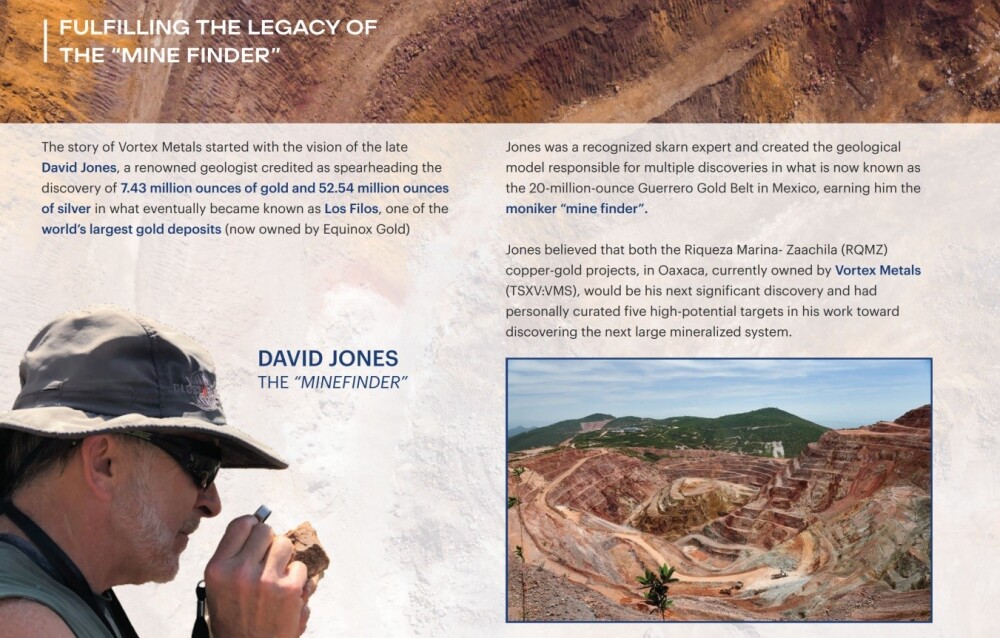

A renowned geologist, the late David Jones, who became known as "The Mine Finder" who discovered one of the biggest gold deposits in the world, believed that both of the copper-gold properties in Mexico detailed above now owned by Vortex Metals would turn up his next significant discovery and with exploration ongoing that may well happen.

Catalysts this year that are likely to support appreciation of the stock, in addition to the big general one common to most copper–gold stocks, which is the ongoing strong bull market in copper and gold, will be continuing exploration of the Illapel property in Chile involving a drilling program and the continued advance towards permitting the two VMS projects in Mexico.

As CEO Vikas Ranjan commented back in January, "We believe that 2024 will be a key year for Vortex, as the company will be advancing towards permitting both VMS projects in Mexico while advancing the highly prospective brownfield Illapel project in Chile. The Illapel project is adjacent to the Rio 27 mine, which has processed approximately 400,000 tonnes of ore at an average grade of 1.39% copper. Our senior geologist, John Larson, has identified highly prospective drill targets adjacent to and along the strike from the Rio 27 mine. We are excited to begin the process of the first phase of drilling once the transaction is approved by the TSX Venture Exchange."

And there has since been news on this front with an announcement on March 12 that Vortex Metals received community approval for Zaachila.

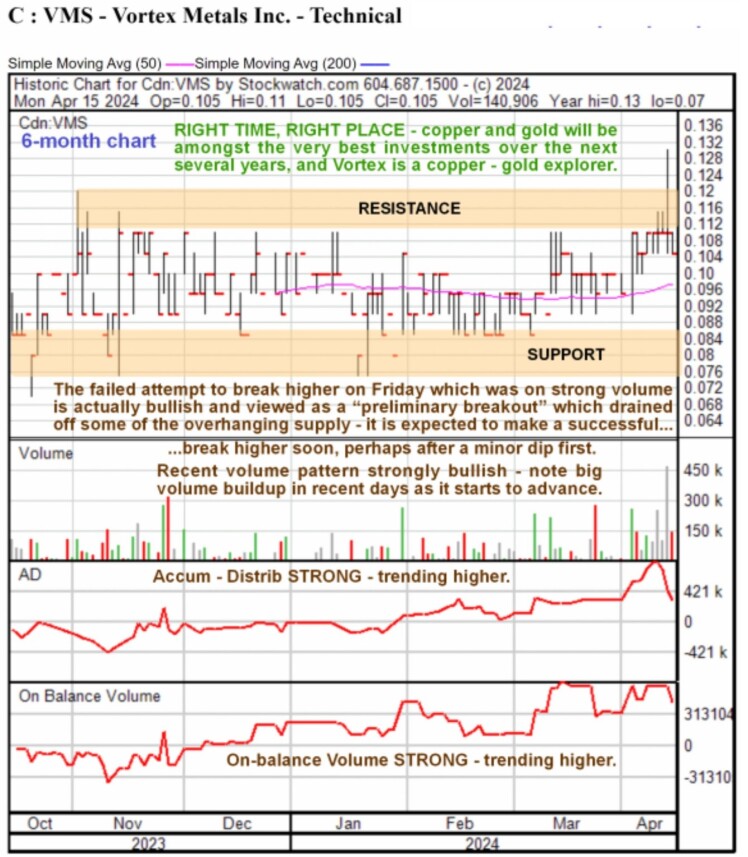

Turning now to the stock charts for Vortex, we see almost immediately that it will be among the copper-gold stocks that perform well going forward.

On its 2-year chart, we can see that Vortex has just completed the second low of a large Double Bottom and is starting to advance out of this low. Since it is still not far from this low, it is considered to be at a very good entry point in this area.

The time spent marking out this second low has allowed the 200-day moving average to drop down to the vicinity of the price, putting it in a position to turn up and start rising in the event that an uptrend becomes established as soon as expected. A crucially important bullish point to observe on this chart is the strongly uptrending volume indicators, the Accumulation line, and On-balance Volume line as a result of the more difficult-to-discern positive volume pattern.

That these indicators are rising in tandem like this is a powerful sign that a major new bull market is incubating, and given how the company has positioned itself and the extraordinarily positive outlook for both copper and gold prices, it would be surprising if it wasn't.

On the 6-month chart, we can see recent action in more detail and how the second low of the Double Bottom that we looked at on the 2-year chart has taken the form of a trading range bounded by the support and resistance shown.

Even though its attempt to break out of this range last Friday failed because the sector reversed dramatically to the downside due to profit-taking ahead of the Iran attack on Israel but mainly due to the announcement after the close of trading the day before, Thursday, of a CA$1.45 million non-brokered private placement, this action is viewed as bullish and as a sign that "it wants to break out" and will soon, probably after completion of the funding which is expected to be achieved soon, especially as the attempt to break out was on strong volume.

Friday's action is thus regarded as a "dress rehearsal" or preliminary breakout that has served to signal its intent and also drained off some overhanging supply ahead of a successful breakout soon that will lead to a sustained advance, even if we see a minor dip short-term first towards the funding price at 9 cents.

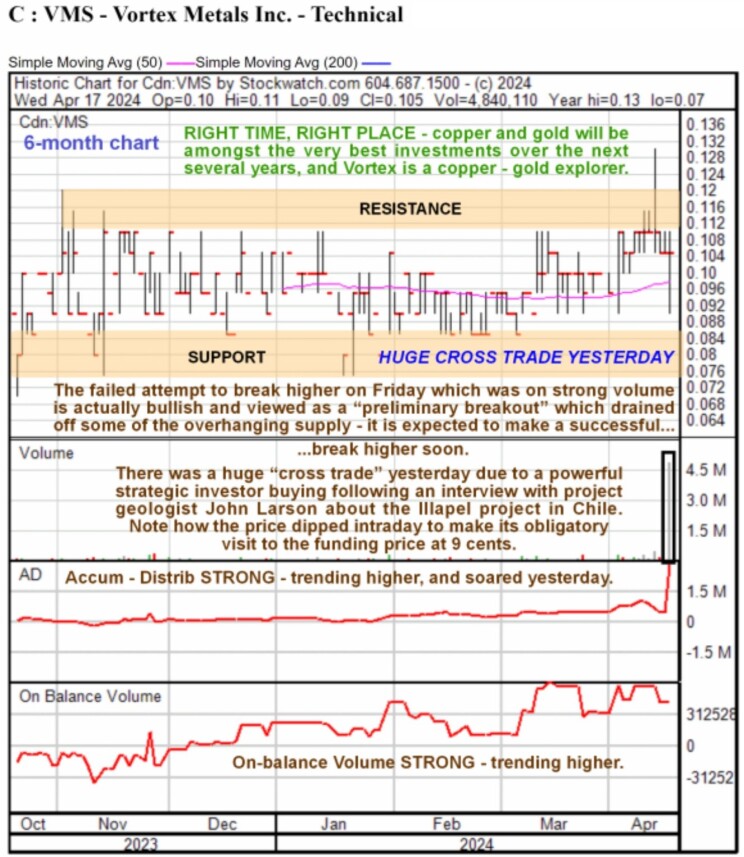

A new development is that there was a massive cross-trade yesterday of at least 2 million shares and probably more like 3 million, which may have been done in stages, which can be seen on the additional 6-month chart added below — the chart above has not been replaced because yesterday's trade was so huge that it has had the effect of "squashing all prior volume flat," so you can't see what's going on prior to it.

The following commentary on this trade has been picked up:

"Vortex Metals Inc. sported a massive cross of 2,000,000 shares a few moments ago, and all I can tell you is that a highly strategic investor has entered the market based upon an interview with project geologist John Larson discussing the Illapel Copper Project in Chile.

VMS is rapidly moving to the forefront in terms of project readiness, as Illapel is currently drill-ready. It is fully permitted and has already fine-tuned its targets, of which three have been prioritized and are ready for immediate probing. As soon as this current financing concludes, I believe that mobilization will commence, and the drill program will be soon underway.

VMS is a short-term Buy for a move to CA$0.30-CA$0.35."

This was from Michael Ballanger.

With Vortex Metals very close now to embarking on a major bull market, it is rated a Strong Buy here for all timeframes with an awareness that it could dip a little more short-term toward the funding price at 9 cents, which would provide an excuse to buy more.

Vortex Metals' website.

Vortex Metals Inc. (VMSSF:OTCMKTS;VMS:TSX;DM8:FSE) closed at CA$0.13, US$0.094 on April 22, 2024.

| Want to be the first to know about interesting Base Metals, Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.